Check out our blogs and keep up-to date with everything about CPA tax services. Plus, we talk about what you can do in Atlanta.

WE ARE YOUR PROFESSIONAL ACCOUNTING FIRM IN CHICAGO

We help small businesses grow by managing their tax and accounting needs in and around Chicago

Our CPAs, Enrolled Agents and other licensed tax professionals represent taxpayers before the IRS, keeping taxpayers out of tax trouble. We know the rules for tax debt relief. We negotiate with the IRS and the state, so you do not have to.

We are experts in all aspects of tax return preparation and tax planning. Our team of tax accountants knows how the IRS works. And we know QuickBooks too.

Our friendly CPAs, Enrolled Agents and tax professionals will help you and your small business save taxes, stay out of tax trouble and keep more of your earnings in your pocket.

Massey and Company CPA serves clients throughout the Chicago area. We are a tax and accounting firm that caters to small businesses, entrepreneurs and their families.

We are a modern, cloud-based CPA firm. Based in Atlanta, we are expanding into the Chicago market. Our team of CPAs, Enrolled Agents, tax accountants and accounting professionals is here to serve you.

We want to be your CPA firm!

IRS and State Tax Services

Massey and Company CPA provides tax preparation, strategic tax planning and other CPA tax services to clients in Chicago and throughout the country. Our tax accountants prepare IRS tax returns and state tax returns for individuals, partnerships, S corporations, C corporations, nonprofits, trusts, and estates.

Our tax preparation services are guided by the highest ethical standards set by the AICPA and the IRS.

Our tax planning services are creative and above all forward looking. We are always thinking of ways to legally minimize taxes for our clients.

We are not simply “tax season” accountants and tax advisors. Instead, we stay in touch with our clients all year long, looking for tax savings opportunities and keeping our clients out of tax trouble.

We want to be your CPA firm!

Individual Tax Preparation and Tax Planning

Massey and Company CPA provides CPA tax services to clients in Chicago and beyond. Our CPAs, Enrolled Agents and tax accountants are here to assist you with all of your individual tax preparation and tax planning needs. Our tax professionals will advise you about the best way to file your tax return, while also identifying all possible deductions or credits to minimize the taxes that you pay to the government. We take you carefully through the tax preparation process, so you feel comfortable and informed. We will advise you about any potential “red flags” in your return, so you don’t have to worry about the IRS.

Tax planning services are a fundamental offering of our Tax Department. We don’t only prepare tax returns; we also meet with our clients to develop strategies to legally minimize what they pay in taxes now and in the future. Examples of strategies for individuals include charitable giving, gifting to family members, retirement planning, 529 college savings plans, Roth conversions, stock options, state tax credits and investments in rental properties.

Our team of tax professionals is friendly, caring and responsive. Check out our 5-Star reviews on Google!

Business Tax Preparation and Tax Planning

Massey and Company CPA provides one-stop CPA tax services for small businesses in Chicago, including small business tax preparation, tax planning and sales tax services. Our CPAs, Enrolled Agents and tax accountants manage the tax requirements of a wide variety of small businesses, start-ups, real estate investors and nonprofit organizations.

Our focus include income taxes, sales taxes and international tax issues. Our tax accountants work closely with our small business clients to prepare and file their business taxes so that they feel involved and informed every step of the way. We assist our business clients with all tax matters that arise throughout the year. We answer our phones and return messages promptly. We are proactive about tax planning.

We encourage our clients throughout the year to call into the firm to schedule strategic tax planning meetings. Tax planning services for businesses include entity choice, cost segregation for real estate, research and development tax credits, retirement planning, business vehicles, accountable plans, healthcare reimbursement accounts, 1031 exchanges, executive compensation and fixed asset planning.

And we keep our small business clients and investors out of tax trouble.

Accounting, Bookkeeping and QuickBooks Consulting for Small Businesses

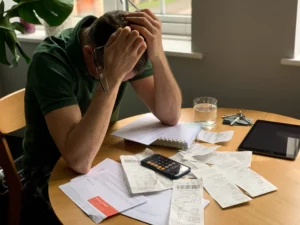

Business tax preparation cannot begin until the bookkeeping and accounting is finished. This can be a real headache for many small business owners.

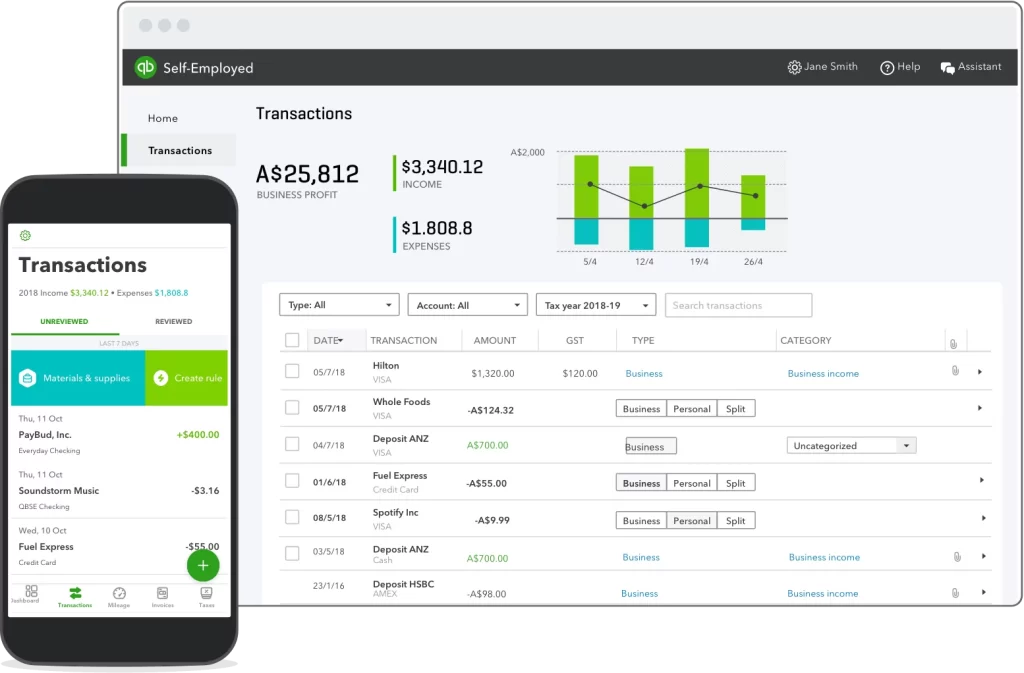

Our accountants, bookkeepers and tax advisors use QuickBooks Online to manage the books and financial records of our small business clients and real estate investors. At Massey and Company, CPA, our goal is to make sure the books remain clean and organized throughout the year, and are ready for tax preparation.

Are your books messy? Don’t worry! Our friendly, responsive accountants and bookkeepers will clean up the books for you and get your business ready for tax preparation.

Our billing for small business accounting and bookkeeping services is based on fixed monthly fees. As a client of our CPA firm, there will be no more billing surprises!

QuickBooks consulting services included diagnostic reviews, staff training, setting up businesses in QuickBooks Online and optimizing financial reports for better financial management.

Our QuickBooks consultants are certified QuickBooks ProAdvisors.

Tax Debt Relief And IRS Audit Defense

A tax collection letter from the IRS is often a nerve-wracking experience. Some people just put these letters off until later. This only adds to the problem, increasing back taxes, interest and penalties.

IRS audits range from simple to complex. Either way, the risks can be significant. Our firm will represent you in an audit, so you can minimize the tax risks and move on with your life. Our audit defense team has your back.

Massey and Company provides a full range of CPA tax and accounting services, including tax representation and tax debt relief solutions. We handle offers in compromise, installment agreements (payment plans), currently non collectible status, liens, levies, wage garnishments and appeals. We have deep experience with the IRS Statute of Limitations, which is a requirement for IRS negotiation.

We also have significant experience with sales tax audits.

We negotiate for you, so you don’t have to.

Payroll Tax Problems

You have a successful small business, but your cash flow dips from time to time, and the payroll tax deposit isn’t made on time. Perhaps you were caught up in other matters and skipped your quarterly payroll tax returns.

Regardless of the cause, you’re behind on your payroll tax filings and payments. You might think you’re temporarily borrowing money from the IRS while your business recovers, but the government doesn’t see it that way.

The IRS wants its payroll taxes and they will go after you for late payments and missing payroll tax returns. Late payroll tax payments are taken more seriously than any other tax issue by the IRS.

Our team of CPAs, Enrolled Agents and tax accountants will resolve your small business tax problems, including payroll tax issues. We are more experienced than most CPA firms in this complex area of tax law.

New Business Formation Services

Our team of tax accountants and tax advisors will assist you with business formation. This include company structuring, entity choice and other start-up services for sole proprietorships, LLCs and S corporations. A properly structured small business allows the business owners to save taxes year after year.

New business formation is a fundamental part of our CPA tax planning services.

We want to be your small business accounting firm, staying with you throughout the life of your business. We have your back.

Blog Timeline

Georgia Tax Credits and Incentives

March 20, 2024

No Comments

Southern Hospitality: How Georgia Welcomes Businesses with Tax Credits and Incentives In the heart of the South, Georgia extends a warm embrace not only through

IRS Audit Guide (Updated for 2024)

March 3, 2024

No Comments

IRS Audit: What to Know, What to Do in 2024 Taxpayers are selected for an IRS audit for a variety of reasons. Some taxpayers are

179D Deduction for Construction and Rehab

February 22, 2024

No Comments

Powerful Tax Incentives for Energy Efficient Projects The 179D tax deduction offers a powerful financial incentive for installing qualifying building systems that reduce energy consumption.

Tax Planning Strategies for Financial Success

October 18, 2023

No Comments

Tax planning is the overall topic of our recent podcast with The Shift Spot, a peer advisory community of fellow business owners who are passionate

Divorce and Taxes: How to Protect Yourself

October 16, 2023

No Comments

Divorce and taxes are the important subject of our live event with Pacific Cascade Legal, a premier family law firm in Oregon and Washington. We

Guide to IRS Statute of Limitations (CSED)

October 12, 2023

No Comments

IRS Statute of Limitations and the Collection Statute Expiration Date (CSED) The collection power of the IRS is restricted by a statute of limitations on

Have Any Questions?

OUR ADDRESS

P.O. Box 421396

Atlanta, GA 3034

United States

Atlanta, GA 3034

United States

Email Us

gary.massey@masseyandcompanycpa.com

WANT TO TALK?

Call Us Atlanta Office

678-235-5460

Call Us Chicago Office

773-828-0551

ABOUT US

MORE LINKS

- Quickbooks Online

Massey Consultancy LLC d/b/a Massey and Company CPA © 2022 Massey And Company CPA. All Rights Reserved

Founded by Gary Massey, Massey and Company is a boutique CPA firm, located in Atlanta, Georgia serving the needs of small businesses and their owners