Check out our blogs and keep up-to date with everything about CPA tax services. Plus, we talk about what you can do in Atlanta.

We help your business grow by taking care of all your tax and accounting needs.

We represent taxpayers before the IRS, keeping taxpayers out of tax trouble, including issues related to federal tax liens. We know the rules for tax debt relief. We negotiate with the IRS and the state, so you do not have to. Unpaid taxes can lead to severe consequences, and we are here to help you resolve these issues.

At Massey and Company CPA, we understand the unique challenges faced by small businesses and entrepreneurs. Our team of experts is dedicated to providing personalized tax planning, tax preparation, and accounting services to help you navigate the complexities of federal and state tax laws.

We know the tax issues. We know our way around the IRS. We know QuickBooks. And we use strategic tax planning to help you save taxes and keep more of your hard-earned profits.

We are committed to helping you save taxes, avoid IRS trouble, and resolve any tax issues or problems that may arise. Our goal is to be your trusted advisor and partner in achieving your financial goals.

Massey and Company CPA, based in Atlanta, GA, provides tax preparation, strategic tax planning and tax representation services throughout Georgia and in states across the country. We prepare IRS tax returns and state tax returns for individuals, partnerships, S corporations, C corporations, nonprofits, trusts, and estates. We also handle quarterly taxes for small business owners, independent contractors and real estate investors.

Our tax preparation services are governed by the highest levels of ethics and due diligence mandated by the AICPA and the IRS.

Our tax planning services are creative and above all forward looking. We are always thinking of creative ways to legally minimize taxes for our clients.

We are not just “tax season” accountants. Rather, we stay close to our clients all year long, identifying tax savings opportunities and keeping our clients out of tax trouble.

We want to be your Atlanta CPA!

Massey and Company, an Atlanta CPA firm, is here to take care of all your individual tax preparation and tax planning needs. Form 1040, the individual income tax return, must be filed accurately and on time to avoid penalties and interest. Our CPAs, Enrolled Agents, tax experts and accountants will work with you to identify all available deductions and credits to minimize your tax liability.

Above all, our team is communicative with our clients. We answer our phones and promptly return our messages. We want you to know that your accounting firm cares about you.

Tax planning services are a fundamental offering of our Tax Department. We don’t only prepare tax returns; we also meet with our clients to develop strategies to legally minimize what they pay in taxes now and in the future. Examples of strategies for individuals include charitable giving, gifting to family members, retirement planning, 529 college savings plans, Roth conversions, stock options, state tax credits and investments in rental properties.

Massey and Company, an Atlanta CPA firm, is your one-stop shop for business tax preparation and strategic tax planning. Whether you have a start-up, an existing small business or a non-profit organization, our CPAs, Enrolled Agents, tax experts and accountants can handle all your tax needs.

Not only do we prepare and file your business tax returns with the IRS and the states, we are here throughout the year to address tax related matters as they come up. And that includes tax representation and audit defense, which many accounting firms do not handle. We keep our clients out of tax trouble.

We encourage our clients throughout the year to call into the firm to schedule strategic tax planning meetings. Tax planning services for businesses include entity choice, cost segregation for real estate, research and development tax credits, retirement planning, business vehicles, accountable plans, healthcare reimbursement accounts, 1031 exchanges, executive compensation and fixed asset planning.

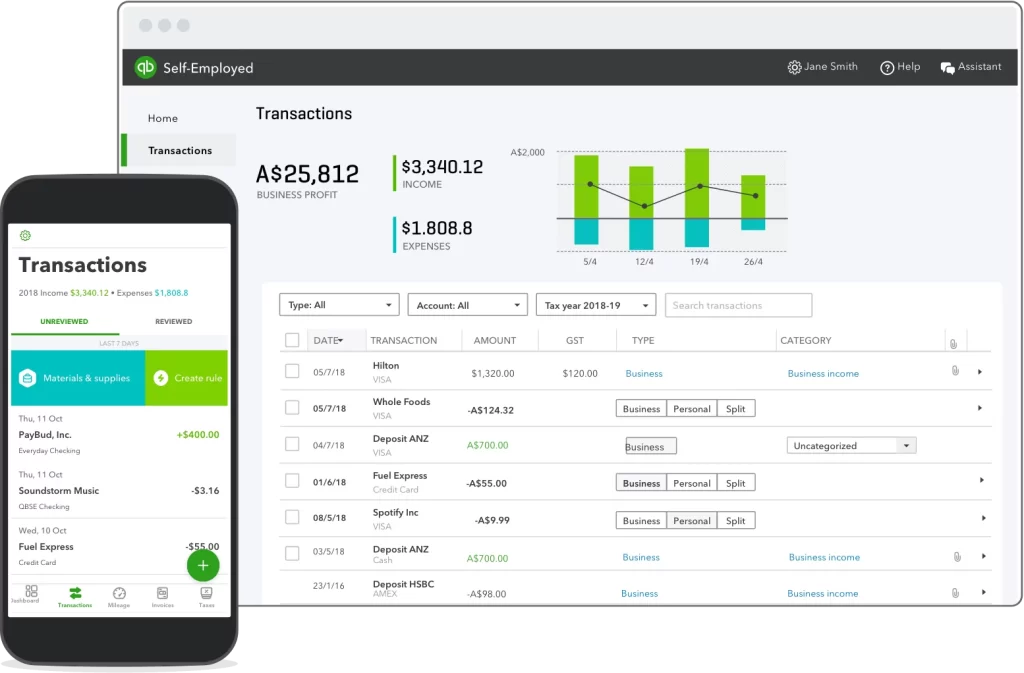

As a professional accounting firm, we offer a range of accounting, bookkeeping, and QuickBooks consulting services to small businesses in Atlanta, Chicago and beyond.

Our team of experts is well-versed in QuickBooks Online and can help you set up and manage your accounting system, ensuring that your financial records are accurate and up-to-date. We can also assist with payroll tax problems, IRS audits, and IRS payment plans, helping you to avoid penalty abatement and other tax-related issues.

Our accounting and bookkeeping services include:

Financial statement preparation

Budgeting and forecasting

Accounts payable and accounts receivable management

QuickBooks setup and training

Financial analysis and planning

By partnering with Massey and Company CPA, you can focus on growing your business while we take care of your accounting and tax needs. Our goal is to provide you with peace of mind, knowing that your financial matters are in expert hands.

Receiving a letter from the IRS can be a stressful situation. Some people simply ignore these letters or save them for another day. This only serves to create further complications.

IRS audits? The response you need to provide might be simple, or it might be very complex. We can help you interpret what the IRS is asking for so you can respond to the letter appropriately and put this behind you.

With offices in Atlanta and Chicago, Massey and Company CPA offers tax debt relief solutions. We deal with IRS problems – everything from filing back tax returns to audit defense. We are experts in IRS matters.

And we can even handle the state, including state sales tax audits.

We negotiate for you, so you don’t have to.

You have a good business, but sometimes your cash flow gets a little low and the payroll tax deposit doesn’t get made on time. Or maybe you just got busy and missed your quarterly payroll tax return filings.

Whatever the reason, you’re now behind in your payroll tax filings or payments or both. You might feel like you’re temporarily borrowing the money from the IRS until your business gets back on track, but the IRS doesn’t see it that way at all.

The IRS needs that money to make Social Security payments among other things and takes late payroll tax payments more seriously than just about any other tax problem.

Our tax debt relief solutions and audit defense services include payroll tax issues for small businesses in Atlanta, Chicago and nationwide.

Our team will assist you with business formation. This include company structuring, entity choice and other start-up services for sole proprietorships, LLCs and S corporations. A properly structured business allows the business owners to save taxes year after year.

New business formations is a key component of our strategic tax planning services.

We want to be your Atlanta small business accounting firm, staying with you throughout the life of your business. We have your back.

Check out our blogs and keep up-to date with everything about CPA tax services. Plus, we talk about what you can do in Atlanta.