What is IRS Notice CP2000?

IRS Notice CP2000 is one of the most common IRS letters that we see in our CPA practice. The IRS mails these notices to taxpayers when information from a third party source (such as a 1099 or W-2) does not match the information the taxpayer reported on their tax return. A CP2000 Notice from the IRS usually means that the taxpayer did not report all their income.

IRS Notice CP2000 is sent by the IRS Automated Under-Reporter (AUR) department. It is generated by a computer at the IRS. But that does not mean you should ignore it. Once you receive a CP2000 letter from the IRS, the government will follow up with repeated letters until the matter is resolved, one way or another.

IRS Notice CP2000 is also known as IRS Letter CP2000 or a Notice of Underreported Income.

Understanding IRS Notice CP2000

The IRS sends Notice CP2000 when information on a tax return does not match the data reported to the IRS by third parties, such as banks, vendors, or employers. Most commonly, the CP2000 relates to income from a tax form that was left off the tax return. That is why it is called an underreported income notice.

Here are examples of forms that can trigger a CP2000 Notice, if the income on the forms is missing from a tax return:

- W-2 (wages)

- 1099-NEC (non-employee compensation)

- 1099-R (retirement distributions)

- 1099-C (forgiveness of debt)

- 1099-MISC (rental and royalty income)

- 1099-B (stock trades)

- 1099-K (payments received from credit cards, PayPal or Venmo)

Notice CP2000 Starts the IRS Audit Process

CP2000 marks the start of a correspondence audit.

Is Notice CP2000 an Audit?

Think of the CP2000 as the start of a “mini IRS audit.” However, a correspondence audit is not as intimidating as a full scale, formal audit. Everything is done through the mail. The IRS auditor will not visit your home or office. Meetings at the IRS office are not required. Nevertheless, the CP2000 does mean that the IRS is reviewing a portion of your return for missing income, even if that review is done by a computer. The proposed changes to your return are automated. It is something like “audit lite.”

The CP2000 will be specific, indicating the name of the business that paid unreported income to the taxpayer. It will also state how much of this income the taxpayer reported on their return, compared to what the business reported as paid to the taxpayer.

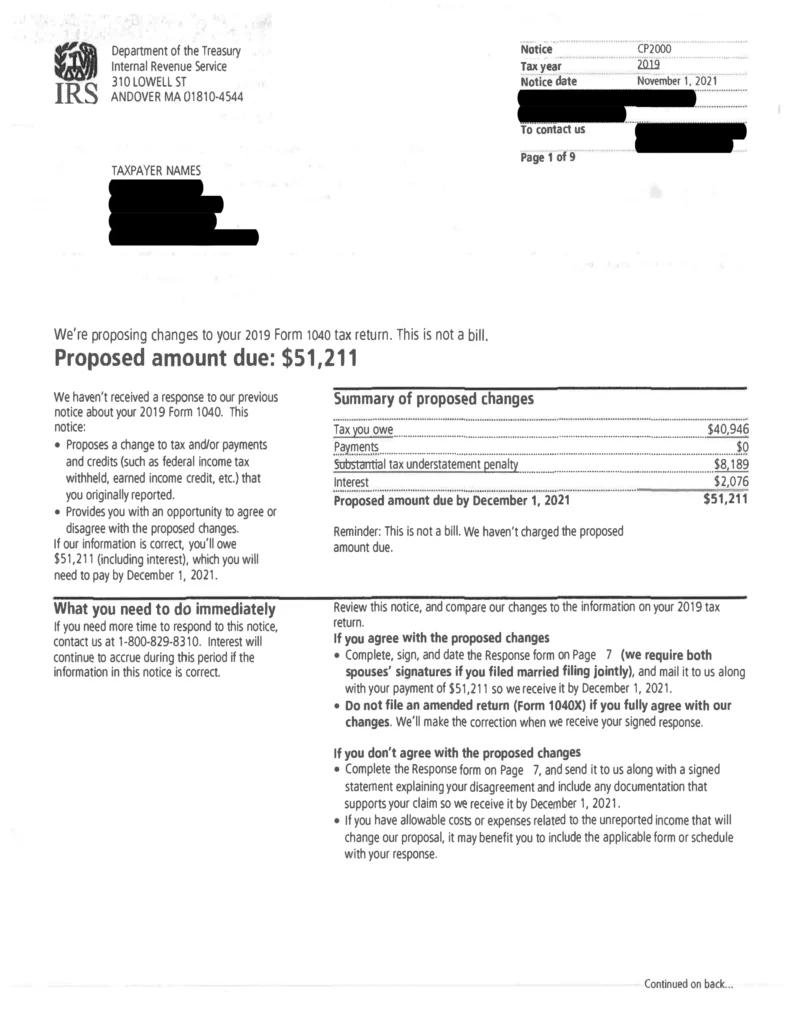

CP2000 includes a Summary of Proposed Changes. This indicates the proposed amount due that the IRS is charging the taxpayer for the income omitted on the return, plus interest and penalties.

How to Respond to IRS Notice CP2000: Proposed Amount Due

The taxpayer is required to respond, stating if they agree or disagree with the CP2000 and the proposed amount due. The taxpayer has 30-days from the date printed on the notice to respond. Responses should be sent by certified mail to the IRS AUR (Automated Under-Reporter) Department.

What if I Agree with a CP2000 Notice?

If the taxpayers agree with the proposed amount due in the CP2000, then they sign the letter and return it to the IRS. The IRS will then follow up with a bill for the additional taxes due, plus interest and penalties.

What if I Disagree with a CP2000 Notice?

The taxpayer may call the IRS at the phone number on the CP2000 to get additional information about the items in the notice and the proposed amount due. IRS telephone assistants can explain the notice and what the taxpayer needs to do to resolve any issues. It should be noted, however, that the IRS telephone lines are notoriously backed up. It is common to wait on hold for more than an hour, only to have the line dropped. You may want to consider using a CPA at this point to resolve the matter. CPAs are authorized to use a special IRS telephone number that gets answered faster. This time savings may be worth paying a fee to a CPA firm.

If the taxpayer disagrees with the proposed amount due in the CP2000, then they complete the appropriate section on the CP2000 that indicates disagreement and return the document to the IRS. They will include a statement indicating the reason for the disagreement. Appropriate documentation should be attached to the form.

Tax Debt Relief: I Cannot Afford to Pay the Tax

If the taxpayer cannot afford to pay the amount due, based on the Summary of Proposed Changes in the CP2000, various IRS tax debt relief programs are available. These programs include the installment agreement (payment plan), offer in compromise and currently non collectible status (CNC).

The installment agreement or payment plan comes in a short-term variety, where payment is made over a few months. There is also a long-term variety, whereby payments can be made over six years. And there are varieties in between. Interest and penalties will continue to accrue until the debt is paid.

The offer in compromise is an enticing program, offering the possibility of “pennies on the dollar.” While this is true, the standards for qualification are high. We recommend careful planning to ensure the greatest likelihood of success with an offer in compromise.

Currently non collectible status (CNC or IRS Hardship Program) stops IRS collection activity on the tax debt. But the taxpayer is required to check in with the IRS every few years to prove their continued inability to pay the tax.

All forms of tax debt relief require negotiation with the IRS and understanding of tax laws, including the statute of limitations. Assistance of an experienced CPA or tax attorney is recommended.

How to Get Penalty Abatement for a CP2000 Notice

Part of the tax debt relief progress is the negotiating with the IRS to remove penalties. Penalty abatement applies to the IRS CP2000, as well as other tax matters.

Often the IRS will agree to remove penalties if the taxpayer has a clean record over the past three years. This means that all returns were filed and there were no other penalties.

In addition, the IRS will sometimes agree to abate penalties based on the merits of the case. This requires more work and a written application. The taxpayer will have to be able to demonstrate that extreme circumstances prevented them from properly reporting the tax matter in question, or paying the tax on time. For these type of issues, assistance of an experienced CPA or tax attorney is recommended.

A CP2000 Notice for My Spouse

Typically, married couples file joint tax returns. This is done because of the lower tax rates associated with married filing jointly (MFJ), as compared to married filing separately (MFS). See our article on The Significance of a Joint Tax Return for more detail.

However, the lower taxes on a joint tax return come with a significant cost. Spouses who file a joint tax return have joint and several liability for the tax on their joint returns. This is a significant responsibility. It means that the IRS may send a CP2000 to either spouse, and attempt to collect the entire tax from either spouse, even after a divorce. It does not matter which spouse earned the money.

Joint liability is a significant responsibility for both spouses. They should be aware of this when signing a joint tax return.

Innocent Spouse Relief

However, there is a way around this problem: Innocent Spouse Relief. This exception to joint liability for taxes comes into play when there is income missing on a joint tax return and making the correction creates a tax liability. The innocent spouse argues that he or she did not know, or had no reason to know, about the missing income. For example, your spouse hid the income from you.

Depending on the facts, this exception can be used for divorced spouses.

If successful, innocent spouse relief is a powerful tool to save taxpayers from a CP2000 notice against a spouse (or ex-spouse).

See our article on Innocent Spouse Relief for additional examples and explanations.

IRS Interest Calculator

Interest on the underpayment of tax is adjusted quarterly. As an example, the IRS increased the interest rate on underpayments for the fourth quarter of 2022 to 6%, for most taxpayers.

Interest will be included in the CP2000, Summary of Proposed Changes. It will be listed separately from the IRS proposed amount due.

The IRS will not agree to remove interest on unpaid or late taxes, even though they will negotiate on penalties.

Ignoring a CP2000 Notice: Statutory Notice of Deficiency

Ignoring any letter from the IRS is a mistake. This is certainly true with a CP2000 notice or IRS audit letter. The matter is not going to go away.

The IRS may send a follow-up letter to taxpayers who do not respond to the CP2000, or if the IRS does not accept the additional information provided. Then, the taxpayer will receive a Statutory Notice of Deficiency.

The Statutory Notice of Deficiency provides detailed information about why the IRS proposes a tax change and how the IRS determined the change. The notice tells the taxpayers about their right to challenge the decision in Tax Court if they choose to do so. The taxpayer must respond within 90 days in order to preserve their right to Tax Court. This is a critical deadline that cannot be extended.

If the taxpayer files the case in US Tax Court, the matter will be first sent to IRS Appeals. This is an excellent opportunity to review the case in an impartial setting. We have very good luck resolving cases at IRS Appeals.

IRS Audit Guide

For a broader, more detailed picture of how IRS audits work, and what to do about them, check out our IRS Audit Guide.

Contact our CPA firm if you are interested in our audit defense services. Our contact information is listed below.

In Conclusion

Keep in mind that CP2000 mismatch notices are produced by computers and are sometimes incorrect. Therefore, carefully review the CP2000 and double check your tax returns. Verify whether or not a W-2 or 1099 was left off the return. If you are are missing hard copies of 1099’s or W-2’s, obtain copies of your IRS Wage and Income transcripts. You can get transcripts online, or ask your CPA to obtain your transcripts for you. Then, compare the transcripts to the returns as filed, as well as to the CP2000.

We have successfully represented taxpayers on numerous occasions where income was left off a return for legitimate reasons. In such situations, a carefully worded and compelling response to the CP2000 should be drafted and sent to the IRS, along with documentation as proof.

If that does not work, the next step is IRS Appeals, where many tax issues get favorably resolved in the end. Fear not, check out our Guide to IRS Appeals for additional details about that helpful process.

Massey and Company CPA is a boutique tax and accounting firm serving individuals, small businesses and non-profits in Atlanta, Chicago and throughout the country. Our Tax Department provides tax return preparation, tax planning, IRS tax problem resolution and IRS audit services. Our Accounting Department provides small business accounting and bookkeeping services using QuickBooks Online.

You are welcome to contact our CPA office to request assistance with your tax and accounting matters. We can be reached by telephone at 678-235-5460 (Atlanta) or 773-828-0551 (Chicago). To reach us online, contact us here.

You are also welcome to reach out to us by email at gary.massey@masseyandcompanyCPA.com.

For more information about the tax and accounting services we provide, visit our Home Page!

Check out our 5-Star Google reviews here!

We want to be your CPA firm!