This is the first in our series of reports analyzing federal tax liens on Georgia businesses. Along with tax levies and garnishments, federal tax liens are one of the most powerful weapons available to the IRS in its efforts to collect back taxes.

As of 2022 there were more than 15 million taxpayers nationwide in the IRS Collection Division inventory. It is the mandate of this department at the IRS to collect unpaid taxes. Tax liens are one the tools that they use to do this.

The purpose of this new series of reports is to analyze federal tax liens at a micro level. We are starting our analysis with Alpharetta, Georgia.

Source Data for Statistics on Federal Tax Liens

Our analysis is based on data obtained from the IRS under a Freedom of Information Act (FOIA) request.

This data includes approximately 2.3 million federal tax liens issued against businesses nationwide. Furthermore, our source data includes nearly 51,500 federal tax lien records issued on Georgia businesses.

Our source data does not include IRS tax liens on individuals. Therefore, IRS tax liens on individual taxpayers are not considered in this report.

Our source data covers the period from 1984 to 2022.

What is a Federal Tax Lien?

There are three requirements for a valid federal tax lien:

- The IRS has assessed the tax liability

- The IRS has given the taxpayer notice of the amount of tax assessed and has demanded payment

- The taxpayer has failed to pay the amount assessed within 10 days after notice and demand by the IRS

Notice of Federal Tax Lien

The IRS will issue a Notice of Federal Tax Lien when a taxpayer owes more than $10,000 to the IRS. The purpose of the Notice is to inform creditors that the IRS is owed taxes and has an interest in the taxpayer’s assets.

Release of Federal Tax Liens

Federal tax liens are self-releasing. This means that tax liens automatically release after the expiration of the collection statute of limitations, which is generally 10 years. The date on which a tax lien expires is known as the Collection Statute Expiration Date (CSED).

When a federal tax lien self-releases on the Collection Statute Expiration date, the tax due to the IRS, along with penalties and interest, simply goes away.

Status of Federal Tax Liens

Federal tax liens may be divided into three categories, as follows:

- Open: the lien is active and in force

- Released: the IRS has been paid, either in full or in part. Partial payments will release a lien when they are made pursuant to an accepted Offer in Compromise.

- Self-released: the 10-year statute of limitations period on the tax debt has expired

Statistics on IRS Tax Liens Nationwide

The IRS reports the number of federal tax liens on a nationwide basis in Table 25 of its annual IRS Data Book. This data includes federal tax liens filed on all taxpayers, both individuals and businesses. The data is reported according to the fiscal year of the IRS, which runs from October 1 through September 30 of the following year.

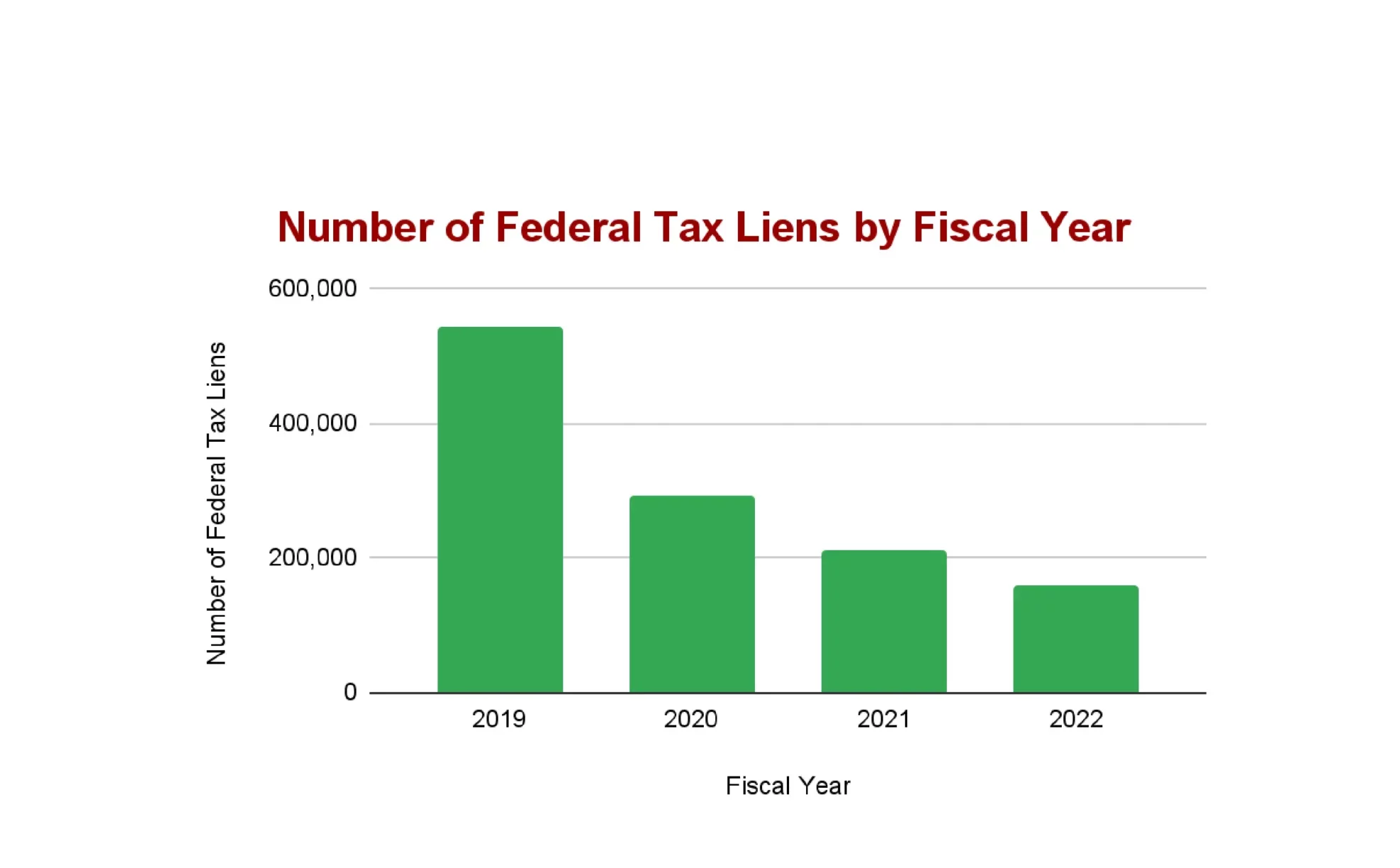

According to the IRS Data Book, the total number of federal tax liens issued by the IRS over the past several years, on a nationwide basis, is as follows:

- Fiscal Year 2019: 543,604

- Fiscal Year 2020: 291,081

- Fiscal Year 2021: 212,251

- Fiscal Year 2022: 157,323

We have summarized these statistics in the following table:

This data shows a year by year reduction in the number of federal tax liens nationwide over the past several years. This is due primarily to the suspension of most IRS collection activities due to the COVID-19 pandemic, which began in 2020.

The purpose of the suspension of collection activities was to provide relief to taxpayers and to ensure the health and safety of both taxpayers and IRS employees.

Where is Alpharetta, GA?

Alpharetta is a city in northern Fulton County, Georgia. It is part of the Atlanta metropolitan area.

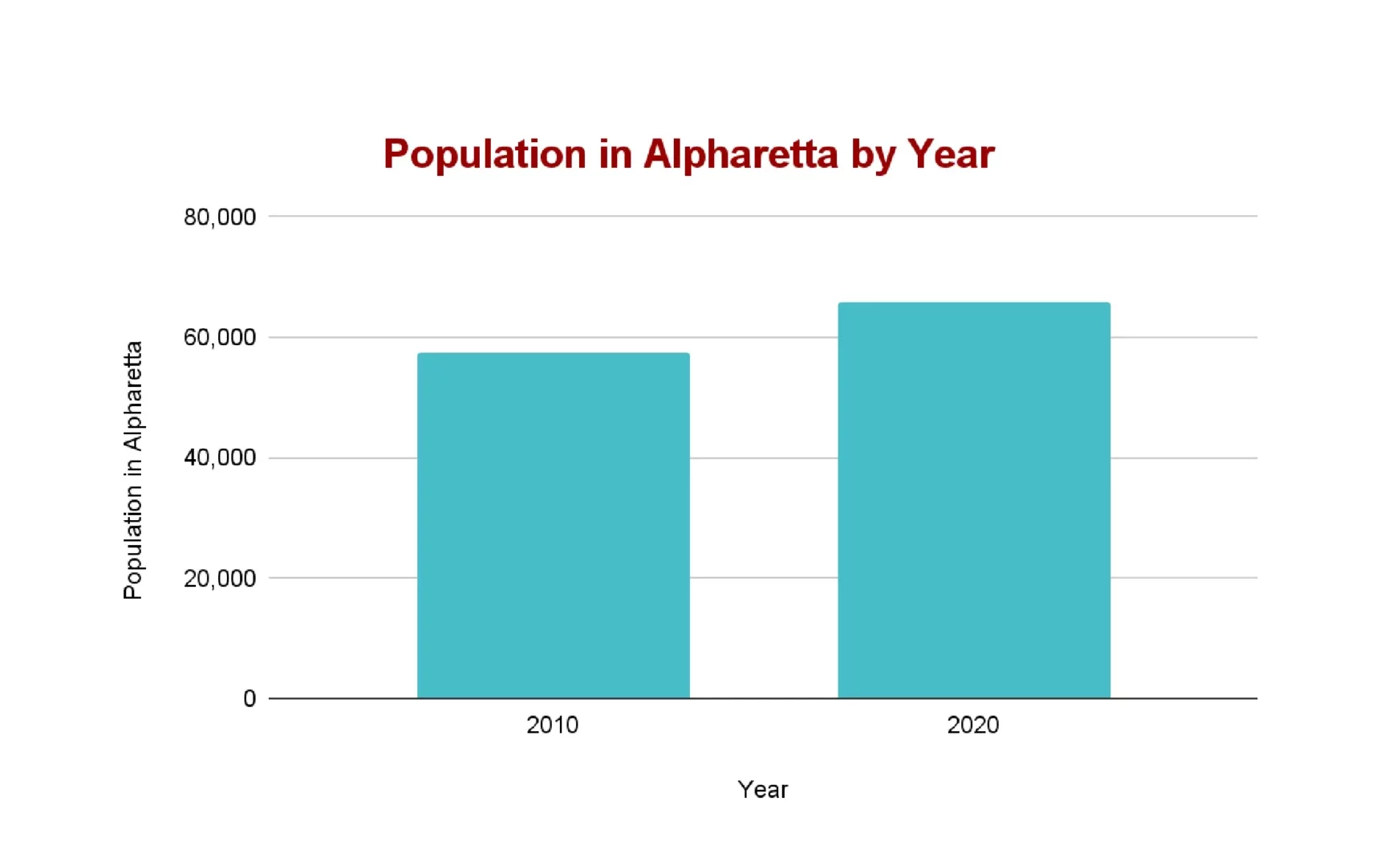

According to the 2020 federal census, the population of Alpharetta was 65,818. In 2010, the population of Alpharetta was 57,551. This represents a population increase from 2010 to 2020 of 14.4%.

See our table below.

Federal Tax Liens on Alpharetta Businesses from 1999 to 2022

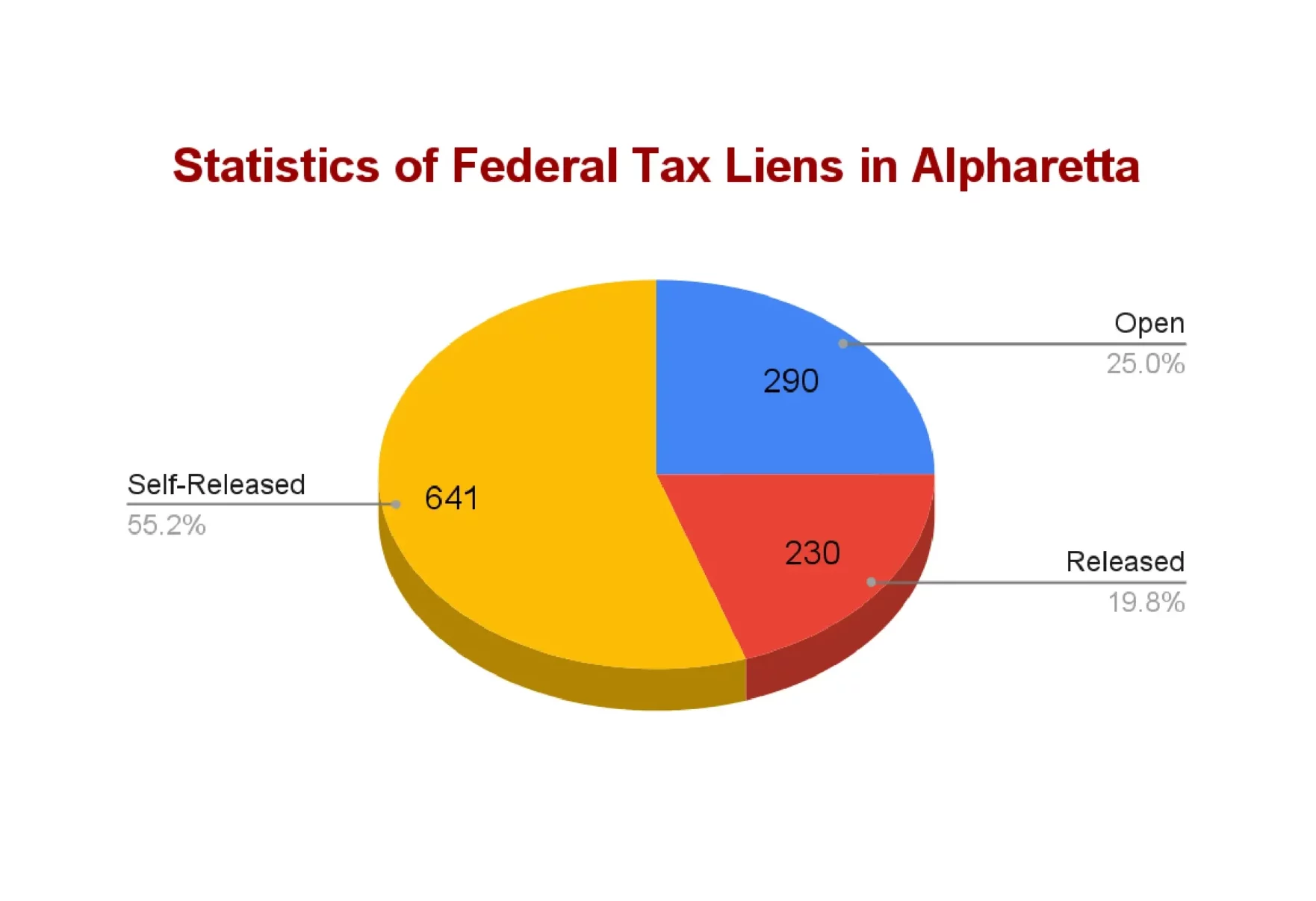

According to our data, the IRS issued 1,161 federal tax lien records on businesses in Alpharetta from 1999 to 2022.

These liens records may be subdivided as follows (as of the date of this writing):

- 641 federal tax lien records on businesses self-released due to the expiration of the 10-year statute of limitations on IRS collections (55.2%)

- 290 federal tax lien records on businesses that remain open (25%)

- 230 federal tax lien records on businesses released by the IRS due to payment or settlement of the tax (19.8%)

The following table summarizes these statistics:

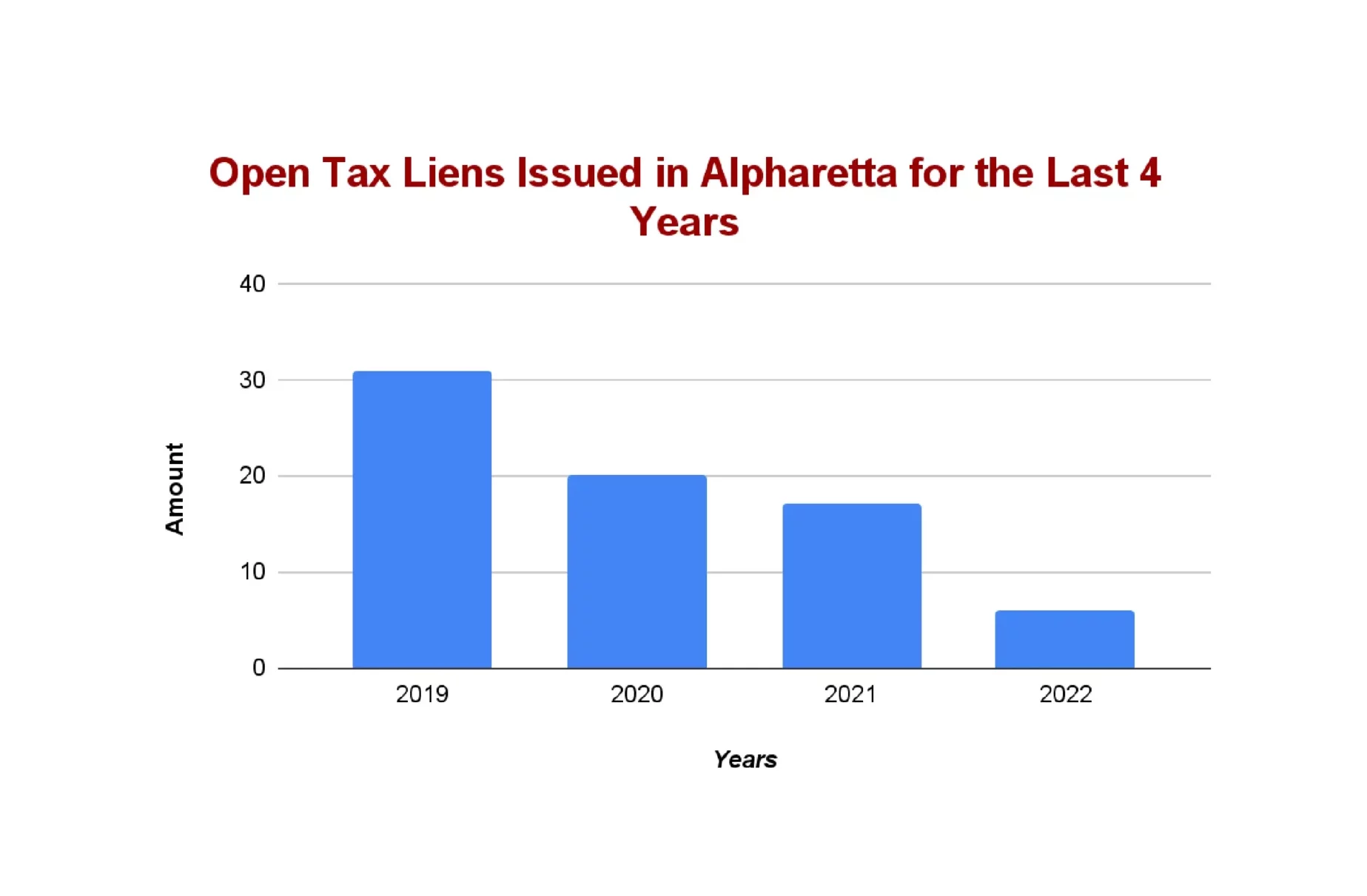

Federal Tax Liens on Alpharetta Businesses (2019-2022)

Over the last four years, the number of open IRS tax lien records issued on business in Alpharetta decreased every year.

See our table below.

Dollar Value of Federal Tax Liens on Alpharetta Businesses (2019-2022)

According to our research on tax liens from 2019-2022, the highest dollar value of an open federal tax liens on a business in Alpharetta, GA was approximately $3 million.

What Did We Learn?

In summary, we learned the following from our study of federal tax liens on businesses in Alpharetta, GA:

- Although the population of Alpharetta, GA increased by 14.4% from 2010 to 2020, the number of federal tax liens on business in Alpharetta substantially decreased during the period 2019-2022. This change is consistent with the decrease in federal tax liens nationwide.

- It is probable that the COVID pandemic of 2020 is the direct cause for this decrease. We expect that federal tax lien activity will increase, both in Alpharetta and nationwide, as the COVID pandemic of 2020 recedes into history.

- Even during this period of decreasing number of tax liens, the dollar value of tax liens in Alpharetta is in the millions of dollars. This represents taxes, penalties and interest owed by Alpharetta businesses to the IRS. In other words, federal tax liens remain a tool of choice for businesses that owe back taxes to the IRS.

- More than half of federal tax liens on Alpharetta businesses self-released. In other words, the majority of these tax liens stayed open until the end of the 10-years statute of limitation period. The taxes, penalties and interest represented by these liens were not paid to the IRS. After the expiration of the statute of limitations on tax collections, these amounts were no longer due to the IRS and the businesses impacted by these liens no longer had to worry about them.

You are welcome to contact us if you have questions on this report, or if you need assistance with federal tax liens.

You can reach us by telephone at: 678-235-5460 or 773-828-0551.

Or you can email us at: gary.massey@masseyandcompanyCPA.com.

Massey and Company CPA is a boutique tax and accounting firm serving individuals and small businesses in Atlanta, Chicago and throughout the country. Our services include tax return preparation, tax planning for businesses and individuals, IRS tax problem resolution, IRS audits, sales taxes, and small business accounting and bookkeeping.

We want to be your CPA firm!

Thank you to Diego Martinez for his contributions to this report.

And thank you to Eric Green, founding partner of Green & Sklarz LLC, and the Tax Rep Network for assistance with this report.