Guide to Tax and IRS Rules for Rental Real Estate | Tax Guidelines

The tax rules for rental real estate investors offer many tax advantages. Due in large part to the tax advantages, investing in real estate is very popular among people looking for an alternative source of income or side gig. Our Atlanta-based CPA firm probably sees more tax returns with real estate issues than just about […]

Top Reasons to Hire a Tax Strategist for Your Tax Planning

A tax strategist assists individuals and businesses to minimize their taxes. The tax plans that they develop are made to ensure that the client stays within the law and to minimize the risk of IRS audit. This article explores the essential roles of a tax strategist and the advantages of regular tax planning. Tax strategist […]

1031 Exchange Qualified Intermediary

Section 1031 Exchange for Real Estate Investors – The Basics of Replacement Property During a 1031 exchange, the IRS requires the use of a Qualified Intermediary (QI). The QI is responsible for documenting and managing the process of a 1031 exchange under Internal Revenue Code Section 1031. This article reviews the role of a QI […]

Can You 1099 a Family Member? A Guide to Paying Relatives in a Small Business

Benefits and Considerations of Hiring Family Members Hiring family members can bring numerous benefits to a small business, making it a popular choice for many entrepreneurs. One of the most significant advantages is the potential for tax benefits. By hiring family members, business owners can often reduce payroll taxes and claim dependents on their tax […]

Mastering the IRS Offer in Compromise: Reducing Tax Debt

Are you overwhelmed by tax debt and looking for a solution? An IRS offer in compromise (OIC) might be the lifeline you need. This program allows eligible taxpayers to settle their tax debts for less than the total amount owed. In this article, we’ll explain what an OIC is, how to determine if you qualify, […]

How to Negotiate with the IRS: Resolving a Tax Debt

Understanding Tax Debt Relief Tax debt relief refers to the various options available to individuals and businesses struggling to pay their tax obligations. The IRS offers several programs and services to help taxpayers manage their tax debt, including installment agreements, offers in compromise and tax penalty abatement. Understanding these options is important for taxpayers who […]

IRS Form 8300: Cash Sales over $10,000

IRS Form 8300 is the form that businesses use to report the receipt of cash payments over $10,000. It applies to the purchase of both goods and services. Generally, businesses must file Form 8300 within 15 days after receiving cash payments over $10,000. We recommend that Form 8300 be filed online through electronic filing, rather […]

Top Tips for Managing a GA State Tax Lien

A GA state tax lien is a legal claim on your property due to unpaid state taxes. This article will explain what a GA state tax lien means for you, how it’s filed, its effects on your property, and ways to remove it. Key Takeaways Georgia state tax liens are serious legal claims on property […]

Guide to IRS Statute of Limitations (CSED)

Understanding the IRS Statute of Limitations The IRS statute of limitations is an important concept for taxpayers to understand, as it determines the period during which the IRS can collect taxes, penalties, and interest from a taxpayer. The standard statute of limitations for tax debts is 10 years, beginning from the date the tax return […]

Georgia Tax Credits and Incentives

Southern Hospitality: How Georgia Welcomes Businesses with Tax Credits and Incentives In the heart of the South, Georgia extends a warm embrace not only through its famed hospitality but also by offering a collection of tax incentives and credits designed to foster business growth and innovation. The state’s generous offerings support Georgia businesses across a […]

Hobby Loss Rules: What to Do?

Hobby Loss Rules: Can You Deduct Hobby Expenses? The Internal Revenue Service (IRS) has specific rules regarding the deductibility of hobby expenses, known as the Hobby Loss Rules. These rules are designed to prevent taxpayers from claiming deductions for expenses related to activities that are not engaged in for profit. Taxpayers can deduct hobby expenses, […]

Divorce, Taxes and Conflict of Interest: Working with a CPA

Understanding the Divorce Process and Taxes The divorce process can be complex and emotionally challenging, and taxes are an essential aspect to consider. Understanding the tax implications of divorce can help you make informed decisions and avoid potential pitfalls. The divorce process typically involves several stages, including separation, divorce filing, discovery, and settlement or trial. […]

Guide to Your Georgia State Tax Refund Status

Wondering how to check your Georgia state tax refund status? This guide walks you through the process using the Georgia Tax Center portal, explains typical processing times, and highlights common reasons for delays. Read on to understand everything you need for tracking your refund efficiently. Key Takeaways Taxpayers can easily check their Georgia state tax […]

Top IRS Audit Triggers and Data Analytics

Curious about what might trigger an IRS audit? This article delves into the key IRS audit triggers you should be mindful of. From discrepancies in your tax return and unreported foreign assets to the use of advanced data analytics tools by the IRS, we explore the top factors that could place you under IRS scrutiny. […]

Tax Debts and Bankruptcy

Does bankruptcy clear tax debt? It depends on the type of tax debt and specific conditions. This article will explain which tax debts can be discharged, the criteria to discharge tax debt, and the impact of different bankruptcy chapters on tax debt. Key Takeaways Bankruptcy can discharge certain types of tax debt, primarily income tax, […]

🎉WOOHOO!! We Made the Best of 2024 My Dunwoody List 🎉

Exciting News!!! Massey and Company CPA has been recognized as the best CPA firm in Dunwoody in 2024 by Atlanta Best Media! Thank you for the support of our clients and our amazing Team, who have made this possible. We are so thrilled with our growth over the past 10 years. Click HERE to meet […]

How to Qualify for Innocent Spouse Relief: A Simple Guide

Innocent spouse relief is an IRS tax provision that can protect you from your spouse’s incorrect tax filings. If you were unaware of errors on your joint tax return and are now facing unfair tax liabilities, this relief may be for you. In this guide, we will cover what innocent spouse relief is, who qualifies, […]

Are HOA Fees Tax Deductible? Your Ultimate Tax Guide

Are HOA fees tax deductible? For many homeowners, the simple answer is no; HOA fees are generally considered personal expenses and are not considered tax deductible. However, there are exceptions, especially if you use your home for business purposes or as a rental property. In this article, we’ll explore these exceptions and help you understand […]

Maximize Savings with the Foreign Earned Income Exclusion

The Foreign Earned Income Exclusion (FEIE) allows you as a U.S. citizen working abroad to exclude up to $126,500 of your foreign-earned income from U.S. taxes in 2024. Understanding how to qualify and make the most of this exclusion can significantly reduce your tax burden. In this article, we’ll break down the eligibility criteria, benefits, […]

Ultimate Guide to Tax Write Offs for Vehicles Over 6000 lbs in 2024

If you’re a business owner, understanding the tax code related to the tax write off for vehicles over 6000 lbs is crucial. This guide explains how you can leverage Section 179 to deduct the cost of qualifying vehicles, potentially saving thousands on your taxes. Read on to learn about eligibility criteria, the types of vehicles […]

Leasehold Improvements: Tax Implications for Landlords & Tenants

Leasehold improvements are changes made to rental properties to meet tenant needs. These can include new partitions, flooring, and fixtures. This article explores the benefits, tax implications, and who typically covers the costs of leasehold improvements. Key Takeaways Leasehold improvements are custom modifications made to enhance leased spaces, tailored to tenant specifications, significantly impacting property […]

How to Handle a CP14 Notice from the IRS

An IRS CP14 notice means you owe taxes to the IRS. This guide will explain why you got the notice and what you need to do next. Key Takeaways A CP14 notice from the IRS indicates outstanding tax debts and includes details such as the amount owed, reasons for the balance, and instructions for payment. […]

Understanding What Is a Single Member LLC: A Quick Guide

What is a Single Member LLC? A Single Member LLC, or limited liability company, is a business structure that provides one owner with liability protection and tax benefits, merging the simplicity of a sole proprietorship with the advantages of a corporation. This article will examine its definition, operation, tax treatment, comparisons with other structures, and […]

Do Venmo and Other Cash Apps Report to IRS for Personal Use?

Curious if Venmo, Zelle, Cash App, PayPal and other payment apps must report your personal transactions to the IRS? The short answer is no, payment apps on phones do not report personal payments. However, the scenario for payment apps changes when it comes to business payments. Venmo and Your Tax Return Handling tax reporting for […]

Top Tips for Filing Form 843 to Request IRS Penalty Relief

Form 843 allows you to request relief from IRS penalties, interest, and certain taxes. Whether you’re dealing with excessive withholding, penalties or errors, this guide will help you work your way through the filing process. Key Takeaways Form 843 allows taxpayers to request relief from specific taxes, penalties, and interest, but does not guarantee total […]

Mastering QuickBooks Online Receipt Capture | Your Ultimate Guide

QuickBooks Online Receipt Capture is an essential feature that helps businesses easily manage and store their receipts. By automating the process of recording and attaching receipts to transactions it ensures accuracy and saves time. This article will guide you through how to use QuickBooks Online Receipt Capture effectively, its benefits, and troubleshooting tips. Key Takeaways […]

How Far Back Can the IRS Audit? Know Your Limits

How far back can the IRS audit your tax returns? Generally, it’s three years, but certain circumstances can extend this period to six or even indefinitely. In this article, we will explore these audit timeframes and what triggers them, helping you understand how to keep your records in order. Key Takeaways The standard IRS audit […]

Mastering Nonprofit Bookkeeping: Best Practices and Essential Tips

Nonprofit bookkeeping is crucial for ensuring financial transparency and compliance in organizations committed to a mission rather than profit. Unlike for-profit accounting, it requires careful tracking of funds in line with donor restrictions and regulatory requirements. This guide will walk you through the essentials of nonprofit bookkeeping, from understanding key financial statements to implementing best […]

What is a Cost Segregation Study?

What is cost segregation? Cost segregation is a federal income tax strategy that allows property owners to accelerate depreciation deductions, ultimately enhancing cash flow and deferring tax payments. A cost segregation study is a strategic tax savings tool that allows companies and individuals who have purchased, constructed, expanded, or remodeled any kind of real estate […]

The Ultimate Guide to Construction Accounting

Construction accounting involves unique practices such as job costing, revenue recognition and managing overhead costs that are specific to each project. For construction companies, understanding these methods is essential to ensure financial health and tax compliance. This article will explain the core principles of construction accounting, the key differences from regular accounting, and best practices […]

Top Benefits of Hiring a Real Estate Tax Accountant

Wondering if a real estate tax accountant can boost your investment returns and minimize taxes? In this article, we’ll show how these specialists handle complex tax laws and keep you out of tax trouble. Key Takeaways Real estate tax accountants possess specialized knowledge of tax laws and strategies specific to real estate, enabling them to […]

Divorce Tax Questions to Ask

Divorce is hard enough without having to worry about taxes too. But taxes are inevitable. And a divorce adds a new layer of complication to tax preparation and tax planning. No one wants to overpay their taxes as the result of a divorce. Filing Taxes After Divorce We have identified a list of common tax […]

Tax and Immigration

The Connection Between Immigration and Taxes Immigration and taxes have a lot to do with each other. In fact, taxation and immigration go hand in hand throughout the USCIS immigration process, creating various tax obligations for immigrants. With over 11 million undocumented immigrants in the US (according to a recent study of the Migration Policy […]

What is a Tax Levy? Understanding the Difference Between Tax Levy and IRS Wage Garnishment

How to Handle an IRS Tax Levy or Wage Garnishment Is there a difference between a tax levy and a garnishment? A federal tax levy is the seizure of money or other property by the government to pay off back taxes. A garnishment is a type of levy, where the IRS seizes wages to satisfy […]

The Complete Guide to Filing Taxes for a Deceased Person

Filing taxes for a deceased person can be complex. This article explains how to file their final tax return, report income, and claim deductions. It also covers the responsibilities of the personal representative, the importance of selecting the correct filing status, and the potential consequences of failing to file a final return. Additionally, the article […]

Sales Tax Audits and Sales Tax Audit Defense

Sales tax audits are on the rise in most states. This is due to budget shortfalls of states across the country. In fact, state auditors are much more aggressive about tax laws than the auditors at the IRS. The state has the power to do massive damage to a business as a result of a […]

IRS Appeals Process

The IRS Appeals Process for collections began in 1998 with the IRS Restructuring and Reform Act. As a result of this law, taxpayers were no longer at the mercy of the IRS. The new rules prohibited the IRS from levying bank accounts and garnishing wages at will. And a formal appeals process was instituted to […]

IRS Audit Guide (Updated for 2024)

IRS Audit: What to Know, What to Do in 2024 Taxpayers are selected for an IRS audit for a variety of reasons. Some taxpayers are chosen due to a document mismatch, such as a return that is missing 1099’s or W-2’s. The IRS computers usually spot missing documents based on the social security number (SSN) […]

Resolve Your Tax Debt To Save Your Passport

Can You Get a Passport if you Owe Taxes? If you have unpaid federal tax debt, you may be in for a surprise. The State Department will revoke your passport, or not issue you a new passport, if you owe a significant tax debt to the IRS. For this reason, taxpayers with tax debts and […]

LT38 Notice: Prepare for IRS Collection Actions

Received an LT38 notice? The IRS is resuming efforts to collect your overdue taxes. Immediate action is needed to avoid further penalties and interest. In our Atlanta-based CPA practice, we have noticed a significant increase in the number of clients receiving IRS notices during 2024, including the LT38 Notice in particular. Our firm’s experience is […]

Solar Tax Credits

The United States and much of the world is turning from fossil fuels to alternative forms of energy. According to an August, 2023 article in the New York Times, this shift is found even in areas dominated by the oil and gas industries. To a certain extent, this shift is encouraged in the United States […]

Mastering IRS CP49: How to Handle Tax Refund Adjustments

IRS Notice CP49 may surprise you, informing you that your tax refund was used to pay off unpaid tax debts. This means the IRS applied your expected refund to settle outstanding liabilities. In this article, we’ll explain why you received Notice CP49 and how to handle its consequences. Key Takeaways IRS Notice CP49 informs taxpayers […]

CP523 Notice: Steps to Keep Your IRS Payment Plan Intact

Receiving an IRS CP523 notice means the IRS intends to terminate your installment agreement due to a default. This notice is a warning that you must take immediate action to keep your plan intact. In this article, we will explain what a CP523 notice is, why you might receive one, and the essential steps to […]

Reasonable Compensation, Payroll and Distributions for an S Corp Owner

Many small businesses are formed as S corporations. S corps have been around for many years. Their popularity has a lot to do with the fact that s corporations offer both tax savings and a high degree of liability protection in the event of a lawsuit. While S corps are very popular, the issue of […]

Top Strategies for Retail Inventory Management

Inventory management software is a key business tool for the retail clients of our CPA firm. In this article, I explain how to understand the basics of inventory, choose the right inventory management software, manage different types of inventory and implement inventory optimization techniques. I will also provide you with practical solutions to use inventory […]

Tax Planning Strategies for Financial Success

Tax planning is the overall topic of our recent podcast with The Shift Spot, a peer advisory community of fellow business owners who are passionate about making radical shifts in their businesses and lives. Tax planning is the selection of legal options to minimize or eliminate taxes. Tax planning includes optimizing the structure of transactions […]

How to Avoid IRS Trouble

The thought of IRS trouble, “red flags” and audits are enough to worry any business owner. In this podcast, we talk about how to avoid IRS tax problems, and what to do if they arise. In the podcast, we cover a variety of topics including: Organizing your business for tax preparation Tax calendar […]

Statistics on Federal Tax Liens in Alpharetta, GA

This is the first in our series of reports analyzing federal tax liens on Georgia businesses. Along with tax levies and garnishments, federal tax liens are one of the most powerful weapons available to the IRS in its efforts to collect back taxes. As of 2022 there were more than 15 million taxpayers nationwide in […]

ERTC: How to Get the Employee Retention Tax Credit – Updated as of 9/14/2023

Important ERTC Update as of September 14, 2023 Amid rising concerns about a flood of improper Employee Retention Credit (ERC) claims, the IRS ordered an immediate moratorium through at least the end of the 2023 year on processing new ERTC claims for the pandemic-era relief program to protect honest small business owners from scams. The […]

Opportunity Zone: Defer or Eliminate Capital Gains

The Qualified Opportunity Zone Program has been around since 2017. It is a valuable tax planning strategy that is available to taxpayers even if they do not own a business. The program provides tax benefits to long term investors in communities called Qualified Opportunity Zones. These are geographic areas that need improvement or development, such […]

Family Business Ideas

Family business owners Olivia and Carmen Amyette, Infinity Energy Advisors, and Gary Massey, owner of Massey and Company CPA were the guests on this episode of Family Business Radio. The subjects of the episode are family business ideas and entrepreneurship. Family Business Ideas – Podcast Olivia and Carmen, her mom, talked about Olivia’s accomplishments and […]

IRS Whistleblower Program: Getting Money from the IRS

The IRS whistleblower program gives the public a unique opportunity to get money from the IRS, instead of paying money to the IRS as is usually the case. Under the whistleblower program, the IRS pays money to people who “blow the whistle” on individuals or businesses who provide information to the government regarding tax underpayments […]

What is a CPA? Certified Public Accountant

As the accounting industry continues to evolve, the demand for CPAs is growing, making now the ideal time to embark on this exciting journey. In this blog post, we will provide a comprehensive guide to understanding “what is a CPA” – the designation, licensure, specializations, and the benefits of becoming a CPA, as well as […]

Trust Fund Recovery Penalty

The Trust Fund Recovery Penalty is a very severe set of rules that are meant to encourage voluntary compliance with our payroll tax laws. Payroll taxes includes the income tax and Federal Insurance Contributions Act (“FICA”) taxes that are withheld from every employee’s paycheck. It also includes the employer portion of FICA. The business pays […]

Do I Need Advisors to Grow My Small Business?

Why a Small Business Should Expand and Collaborate with a CPA, a Business Consultant and other Advisors Guest post written by Tony R. Kitchens Hello, fellow entrepreneurs and small business owners! Today, I want to address a crucial topic that often arises in the early stages of business development: the importance of growing beyond […]

Cloud Accounting Software

Selecting Accounting Software: Which is Right for Your Small Business? Guest post written by Radhika Patke Introduction: Understanding the Benefits of Cloud Accounting Software Cloud accounting software has revolutionized the way businesses manage their financials. With the advent of online accounting tools, businesses no longer have to rely on traditional, on-premise software installations. Instead, they […]

Georgia Offer in Compromise and Tax Payment Plan

Georgia State Tax Forgiveness: How it Works The Georgia Department of Revenue (GA DOR) allows taxpayers to settle a tax liability for less than the total amount owed. This is called an offer in compromise and is one of the more popular tax debt relief programs in Georgia. These programs are also known as […]

Taxes When Selling a Home

Tax Considerations When Selling a Home Many people move during the summer. We see this in our CPA practice every year. Taxpayers who are selling their home may qualify to exclude all or part of any gain from the sale from their income when filing their tax return. When selling a home or residence, homeowners […]

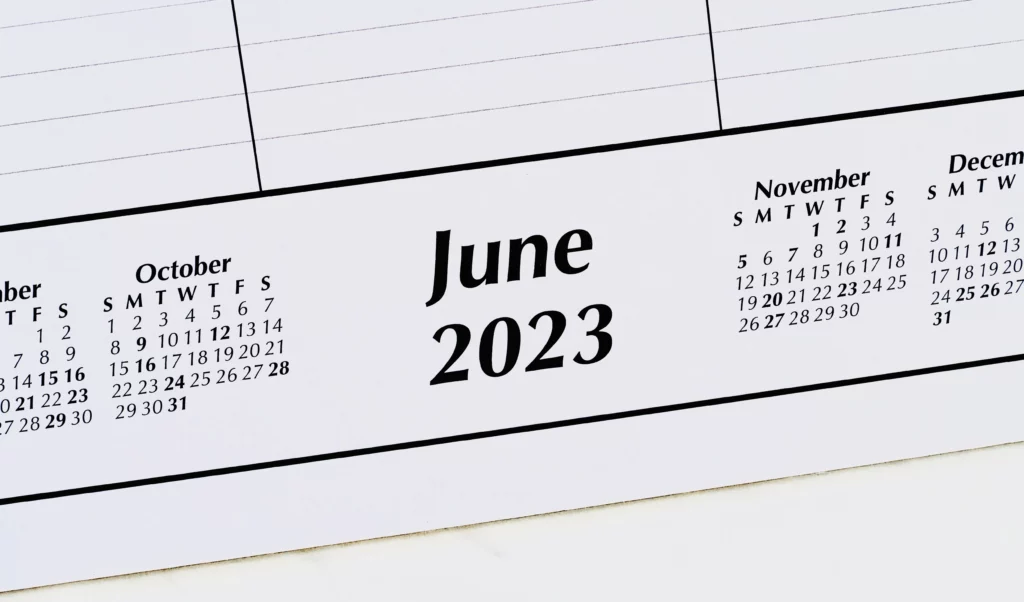

Atlanta CPA Tip: Quarterly Taxes

Atlanta CPA Reminds about Quarterly Taxes Small business owners, investors and independent contractors who are required to pay quarterly taxes to the IRS should consider the June 15, 2023 deadline to stay current with their taxes. Why Make Quarterly Tax Payments? Taxpayers who do not have their taxes withheld from wages (payroll taxes) are required […]

Compensation: How Much to Pay Yourself

Maximizing Tax Savings for Entrepreneurs: Understanding Reasonable Compensation for LLCs and S Corporations Chances are you’ve seen something online about the potential tax savings of switching from an LLC to an S Corporation. However, most of these articles and videos gloss over the most important input of this decision – how much to pay yourself. […]

409A Valuations and Stock Options

Thanks to the IRS, 409A valuations are a regular part of business for companies that issue stock options to employees. This is the reality for any company that uses stock options as part of its employee compensation, including many early-stage companies. Businesses that issue stock options should get a valuation at least annually. IRS Requires […]

Section 1031 Exchange and Delaware Statutory Trust

Delaware Statutory Trust as a Section 1031 Exchange Solution for Real Estate Investors Section 1031 allows an investor to sell real estate for a gain and then roll the proceeds into another “like-kind” asset. This type of transaction is called a “1031 exchange,” which allows the investor to defer paying capital gains tax on the […]

Past Due Tax Returns

Millions of people across the United States do not file tax returns under the mistaken belief that it is best not to file a tax return if they cannot pay the tax. However, past due or unfiled tax returns cause a host of problems. It is both illegal not to file and a strategic mistake. […]

Tax Secrets Webinar – CSG & Massey

Check out our recent tax secrets webinar featuring Core Solutions Group and Massey and Company CPA. In this video, we discuss tax tips that law firms and small businesses can take advantage of to be successful. ____________________________________ If you or someone you know has a tax issue relating to a business, please contact us […]

ProfitSense Podcast

Family Owned Businesses In this inspiring episode of 𝘗𝘳𝘰𝘧𝘪𝘵𝘚𝘦𝘯𝘴𝘦 with Bill McDermott, Gary Massey, CPA discusses the story of his firm and how a little advance planning avoids tax headaches down the road. Bronson Lavender, Senior Vice President with Pinnacle Bank, talks about his passion and calling for helping clients throughout his career in banking. […]

International Tax Update: Undisclosed Foreign Accounts

International tax issues are coming in the door of our Atlanta CPA firm with greater frequency. In part, this is expected in an ever expanding global marketplace. Of greater concern, however, is the “perfect storm” of enhanced IRS international tax enforcement in the age of the internet. Easily available data and information sharing between countries […]

CPA Tax Tips for New Businesses in Atlanta

Owners of new businesses call my tax and accounting office in Atlanta looking for “CPA tax tips.” In this article I will share some of the CPA tax tips that tend to be the most meaningful, practical and useful for creating and running a new business. Stay in Touch with your CPA Expect your […]

Tax Debts: Post-Covid Update

In response to the economic fallout from COVID-19, the IRS suspended attempts to collect back taxes through liens, levies, seizures and other methods. We have learned that the IRS is now restarting the collection of back taxes. There are already more than 25 million taxpayers in America that are in trouble with the IRS, and […]

IRS Tax Relief in 2021

IRS Payment Plans, Tax Liens, Tax Transcripts and More: Navigating the Tax Relief Maze. IRS tax relief includes more than just resolving back taxes. It includes filing missing returns, reconstructing accounting records, interpreting the statute of limitations, analyzing arcane IRS transcripts and the pain and embarrassment of dealing with the IRS. Which way should you […]

Late Tax Returns [updated for 2024]

Late tax returns? Maybe you are due a refund? Atlanta taxpayers, if you are behind in your tax filings by months or even years, this article is for you! We meet with new clients of our Atlanta certified public accounting firm who are due a tax refund from a prior year for which they have […]

How IRS Audits Work [Updated for 2021]

IRS audits are fraught with mystery. Yet, IRS audits generally unfold in a routine manner. It is worth taking time to remove the mystery so people know what to expect and how to deal with it. The reaction that we see among clients in our Atlanta, Georgia accounting firm is nearly universal: The clients receive […]

Does Bankruptcy Clear Tax Debt?

The Basics of Bankruptcy and the IRS. Bankruptcy is one of the tools we discuss in our Atlanta CPA firm with clients who are burdened by back taxes that they cannot afford to pay. Bankruptcy does offer tax relief, but with some critical rules and significant exceptions. It is important that taxpayers understand how these […]

Receipts for Taxes and Small Business Accounting

Keeping receipts for taxes and small business accounting. Both are critical. Whether your business is small and just starting out, or it has grown into a thriving success story, keeping receipts for taxes and keeping the books is of paramount importance to protect your business and allow for continued service to your customers. In the […]

Start Preparing To File Taxes Today

Tax Season 2021 is nearly here. Here are five tips to start preparing taxes today and make tax season less stressful. It is never too early to start preparing for tax season. For this reason, we have arranged five tips to help people file taxes returns on time and to save money along the way. […]

Charitable Contributions: What is New?

Deduct Charitable Contributions Up to $300 in Cash. Charitable contributions in cash of up to $300 made this year by December 31, 2020 are now deductible without having to itemize when filing taxes in 2021. The Coronavirus Aid, Relief and Economic Security Act (The CARES Act) includes several temporary tax law changes to help charities. […]

Business Meals at Sporting Events

Business Meals Before, During or After the Game. Atlanta businesses used to enjoy a tax deduction for taking clients to the Atlanta Braves, the Hawks, the Falcons and other sporting and entertainment events. The same was true for college games (Georgia Bulldogs, Georgia State Panthers and the Georgia Tech Yellow Jackets, just to mention the […]

Penalties for Tax Evasion

A Real-Life Example of Tax Evasion. As a result of an IRS criminal investigation, a Shreveport, Louisiana business owner was sentenced on September 29, 2020. Penalties for tax evasion included 3 years and 4 months in prison and nearly $2 million in restitution payments to the IRS. According to documents and information provided to the […]

Tax Evasion: Recent Case

Tax evasion is squarely in the sites of IRS auditors and the IRS criminal investigation division, especially as it relates to cash-based businesses. Tax evasion is also known as tax fraud. On September 10, 2020 the United States Attorney’s Office announced the sentencing of Mr. and Mrs. Brocato in a court trial that is a […]

Who Does the IRS Audit?

The IRS Audit and the receipt of IRS notices seem to be becoming more and more prevalent among Atlanta taxpayers. The IRS regularly examines third party documentation to identify income that is missing on tax returns. Most commonly, this includes 1099’s and W-2’s. This the cause of millions of IRS notices that go out to taxpayers every […]

STIMULUS CHECKS AND INJURED SPOUSE

Stimulus checks and the Injured Spouse This is a cutting edge tax issue brought to us by Covid-19. We see this in Atlanta, GA, our home town – and it is cropping up around the country as well. There are two types of tax relief for spouses, innocent spouse relief and injured spouse relief. Innocent spouse relief eliminates […]